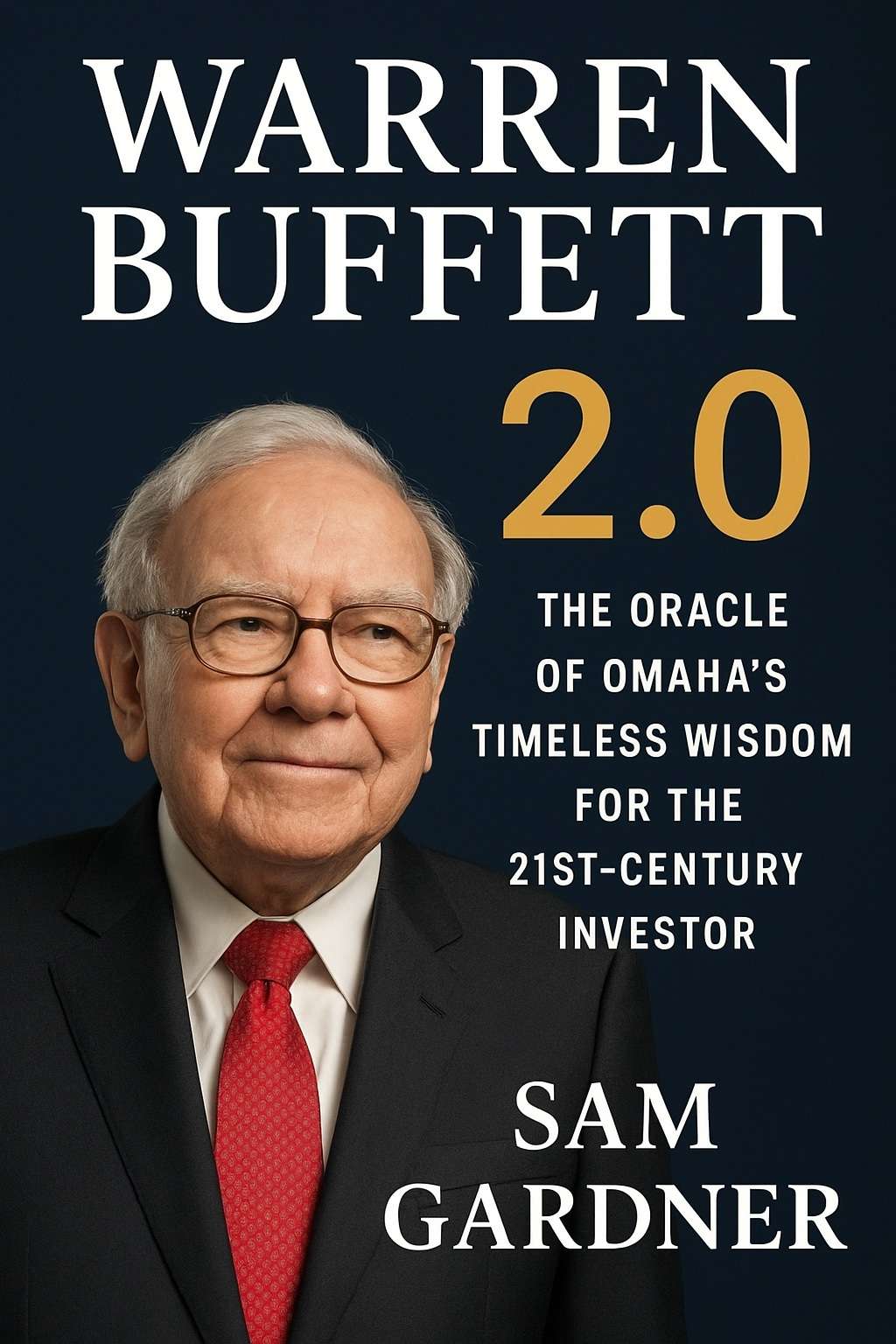

Warren Buffett 2.0: The Oracle of Omaha’s Timeless Wisdom for the 21st-Century Investor

Introduction

In an era dominated by meme stocks, algorithmic trading, and breathless speculation on unproven technologies, a fundamental question nags at serious investors: Are the timeless principles of Warren Buffett still relevant? Or has the digital revolution finally rendered the Oracle of Omaha a relic of a bygone industrial age?

Also, Read:

- Oracle of Omaha: Warren Buffett: The Definitive Biography of America’s Most Celebrated Investor (www.bookscribes.com)

In his groundbreaking new book, Warren Buffett 2.0: The Oracle of Omaha’s Timeless Wisdom for the 21st-Century Investor, author Sam Gardner delivers a resounding and brilliantly articulated answer: not only are Buffett’s principles relevant, they are the essential operating system for thriving in today’s complex markets. This isn’t a biography or a collection of quotes; it’s a practical, forward-looking masterclass that rebuilds the value investing toolkit for the world of AI, crypto, and intangible assets.

About the Author: Sam Gardner (Visit to Sam Gardner’s Author Central Page)

Sam Gardner is uniquely positioned to write this essential update to the Warren Buffett canon. With a rare background spanning both computer science and finance, Gardner has spent his career at the intersection of deep-value analysis and technological disruption. He founded Atherton Capital Management, a research firm dedicated to applying fundamental, Warren Buffett-inspired analysis to technology and innovation-driven businesses. This hands-on experience—coupled with his clear, accessible writing in his popular newsletter, The Rational Investor—allows him to bridge the conceptual gap between Omaha and Silicon Valley with authority and clarity. He writes not as an academic theorist, but as a practitioner who has tested these adapted principles in real markets.

Why Read Warren Buffett 2.0?

WARREN BUFFETT 2.0

The Oracle of Omaha’s Timeless Wisdom for the 21st-Century Investor

Disclosure: This is an affiliate link. We may earn a commission if you make a purchase.

The investment landscape has undergone a seismic shift since Warren Buffett began his partnership. The S&P 500 has transformed from a collection of asset-heavy industrials to a congregation of intangible-rich tech platforms. The average investor is bombarded by data, manipulated by gamified trading apps, and tempted by speculative frenzies. Traditional value investing texts can feel disconnected from this reality.

This book solves that dissonance. It provides the missing manual for anyone who believes in the soundness of Warren Buffett‘s philosophy but struggles to apply “moats” and “margin of safety” to a cloud software company or a social media platform. It’s for the investor who wants the enduring wisdom of Warren Buffett but needs the language and frameworks for a digital economy.

Book Overview: A Journey from Foundation to Future

WARREN BUFFETT 2.0

The Oracle of Omaha’s Timeless Wisdom for the 21st-Century Investor

Disclosure: This is an affiliate link. We may earn a commission if you make a purchase.

Warren Buffett 2.0 is meticulously structured as a comprehensive curriculum. It begins by ensuring the reader has rock-solid command of the original “source code”—the Ben Graham margin of safety, the Charlie Munger upgrade to quality, the power of compounding, and the critical circle of competence.

The book then executes its core thesis: the evolution. Gardner dedicates substantial sections to:

- Redefining the Economic Moat: How to identify durable competitive advantages in businesses built on network effects, data scales, and high switching costs (think Apple’s ecosystem or Amazon’s AWS).

- The Intangible Balance Sheet: A guide to valuing what modern accounting misses—brands, intellectual property, and proprietary data.

- The 2.0 Toolkit: Practical chapters on performing digital scuttlebutt research, reading modern financial statements (with a focus on stock-based compensation and SaaS metrics), and knowing when to sell in a fast-changing world.

- Navigating the New Landscape: Balanced, principled analyses of cryptocurrencies, AI as a moat-builder (or destroyer), and the psychology of investing in an age of information overload.

The final section looks beyond the man himself to the legacy, exploring the succession at Berkshire Hathaway and, most provocatively, whether an AI could ever be programmed with Warren Buffett‘s principles.

Comparison: Warren Buffett 2.0 vs. Other Investing Classics

| Feature | Warren Buffett 2.0 (Sam Gardner) | The Intelligent Investor (Graham) | The Psychology of Money (Housel) | Traditional Buffett Biographies |

|---|---|---|---|---|

| Primary Focus | Applying timeless principles to modern tech & intangible assets. | Foundational philosophy & security analysis for industrial-era assets. | Behavioral lessons and stories about wealth and greed. | Historical account of Warren Buffett‘s life and past investments. |

| Key Strength | Practical frameworks for analyzing SaaS, platforms, AI. Bridges the gap. | Unshakeable bedrock principles (Mr. Market, Margin of Safety). | Accessible wisdom on the soft skills of financial success. | Inspirational narrative and insight into Warren Buffett‘s character. |

| Weakness (for today’s reader) | Requires basic familiarity with Warren Buffett‘s core ideas. | Examples are dated; direct application to tech is challenging. | Light on specific security analysis or valuation techniques. | Offers little direct guidance for analyzing modern companies. |

| Best For | The investor who knows the Warren Buffett basics but needs a 21st-century manual. | The beginner seeking the original, philosophical foundation. | The reader who needs help with behavior and mindset first. | The reader seeking biographical inspiration from Warren Buffett‘s story. |

Key Takeaways from Warren Buffett 2.0

Gardner’s work distills into several powerful, actionable insights for the modern disciple of Warren Buffett:

- The Principles Are Operating Systems, Not Software: The core concepts—seek a margin of safety, invest within your circle of competence, buy wonderful businesses—are immutable. The application (the “software”) must be updated for new business models.

- A Moat is a Moat, Even in the Cloud: Competitive durability is the key, whether it comes from a brand, a cost advantage, or a network effect. The book provides the tools to identify modern digital moats.

- The Ultimate Upgrade is Psychological: The book’s most critical section argues that the 21st-century market is engineered to exploit behavioral flaws. Cultivating an “anti-fragile mindset” and an “inner scorecard” is now the paramount skill, more important than any analytical model.

- You Can (and Must) Expand Your Circle Competently: Ignoring technology is not a viable strategy. Gardner provides a disciplined, systematic process for learning new industries without abandoning the rule of only investing in what you understand.

Conclusion: The Essential Next Volume on the Buffett Shelf

Warren Buffett 2.0 is not a replacement for The Intelligent Investor or The Essays of Warren Buffett; it is the necessary and long-awaited sequel. Sam Gardner has performed an invaluable service for the investing community, translating a classic philosophy into a contemporary dialect. He proves that the Warren Buffett playbook is not locked in the 20th century but is, in fact, the most robust guide we have for the volatility and innovation of the 21st.

For any investor—novice or professional—who feels adrift between the rock of timeless value principles and the hard place of rapid technological change, this book is the bridge. It is the definitive guide to thinking like Warren Buffett in a world he helped create but is now evolving beyond even his own original framework. No serious investing library is complete without this vital update.

10 Must-Read Warren Buffett Books

10 Must-Read Warren Buffett Books

Explore the wisdom of the Oracle of Omaha through these essential books on investing, business, and life philosophy