10 Best Must-Read Financial Books by Robert T. Kiyosaki: Your Blueprint to Financial Freedom

Introduction

For over a quarter of a century, the name Robert T. Kiyosaki has been synonymous with financial rebellion, wealth education, and a radical reshaping of how we think about money, assets, and personal freedom. In a world saturated with traditional financial advice that often leads to the mundane treadmill of “work hard, save, get out of debt, and invest for the long term,” Kiyosaki’s voice emerged as a clarion call for a different path—the path of the investor, the business owner, the visionary who sees money not as an end goal, but as a tool for creating life on one’s own terms. This comprehensive guide delves deep into the core of his revolutionary teachings by exploring the 10 Best Must-Read Financial Books by Robert T. Kiyosaki.

The journey through Kiyosaki’s bibliography is not merely an exercise in reading; it is an immersive course in financial psychology, asset acquisition, and economic history. His books challenge ingrained societal norms, question the very foundation of our education system, and provide a practical, if sometimes controversial, framework for building lasting wealth. The central philosophy, introduced through the parable of his two “dads”—his poor but highly educated real father and the rich, entrepreneurial father of his best friend—draws a stark contrast between the mindset of the middle class and the wealthy. This “Rich Dad” philosophy serves as the bedrock for all his subsequent works.

Why focus on Financial Books by Robert T. Kiyosaki? Because they collectively form a curriculum that mainstream education glaringly omits. They move beyond the “how” of balancing a checkbook to the “why” of financial structures and the “what” of strategic action. These books are about understanding cash flow, the difference between an asset and a liability (as defined by their impact on your pocket), the power of financial education, and the courage to navigate the B-I Triangle. They prepare the reader not just for bull markets, but for the inevitable economic storms, arguing that the rich get richer in crashes because they are educated to see opportunity where others see catastrophe.

This article, presented by BookScribes.com, is your definitive roadmap. We will not only list these transformative Financial Books by Robert T. Kiyosaki but will dissect their unique value, their place in the broader “Rich Dad” canon, and the specific financial awakening each one promises. Whether you are a debt-ridden employee, a budding entrepreneur, or a seasoned investor looking to refine your strategy, this collection holds a key to your next level of financial intelligence. Prepare to have your assumptions challenged, your ambition ignited, and your financial vocabulary permanently altered.

The landscape of personal finance literature is vast, but few authors have built such a cohesive, provocative, and action-oriented empire as Robert Kiyosaki. His books are interlocking pieces of a grand puzzle about money, power, and freedom. As we embark on this detailed exploration of over 10,000 words, remember: the goal is not just to read, but to understand, internalize, and act. Let’s begin by understanding the man behind the “Rich Dad” legacy.

About Robert T. Kiyosaki: The Man Behind the Rich Dad Philosophy

The Architect of a Financial Revolution

Before we delve into the specific Financial Books by Robert T. Kiyosaki, it is crucial to understand the author’s journey. Robert Toru Kiyosaki was born in 1947 in Hilo, Hawaii, into a family of educators. His real father, Ralph H. Kiyosaki, was the Superintendent of Education for the state of Hawaii—a highly respected, intelligent, and traditionally “successful” man. Despite his prestigious job, Robert’s real father struggled financially his entire life, embodying the “poor dad” mindset that values job security, academic accolades, and living within one’s means.

The counterpoint to this was the father of his closest friend, Mike. This man, whom Robert called his “Rich Dad,” was an eighth-grade dropout who built a vast commercial and real estate empire through sheer financial acumen, business savvy, and a different understanding of how money works. The juxtaposition of these two paternal influences—one rich in education but poor in assets, the other poor in formal schooling but extraordinarily rich in wealth—became the foundational conflict that would define Kiyosaki’s life and work.

Kiyosaki’s early career followed a more traditional path initially. He served as a helicopter gunship pilot in the Vietnam War, earning medals for his service. After leaving the Marines, he took a sales job with the Xerox Corporation, a classic “poor dad” approved corporate role. However, the entrepreneurial itch, nurtured by his Rich Dad’s teachings, soon took over. In 1977, he launched a company that brought the first nylon and Velcro “surfer” wallets to market, a venture that initially saw success but ultimately failed, leaving him deeply in debt.

This failure was a pivotal Financial Books by Robert T. Kiyosaki moment in his life, a harsh lesson that fueled his later teachings on risk, resilience, and learning through doing. He rebuilt his wealth through various businesses, including a thriving education company that taught entrepreneurship and investing. It was in the mid-1990s, however, that he found his true calling: financial education through writing.

In 1997, collaborating with accountant and author Sharon Lechter, Kiyosaki self-published Rich Dad Poor Dad. Rejected by countless traditional publishers who deemed its message too radical, the book became a word-of-mouth sensation, championing the then-unconventional ideas that your house is not an asset, that the rich don’t work for money, and that financial literacy is the key to freedom. It spent over six years on the New York Times Best Sellers list and ignited a global brand encompassing books, board games (CASHFLOW®), seminars, and online education.

Kiyosaki is a controversial figure. Critics accuse him of oversimplification, promoting risky strategies, and using his platform to sell expensive courses. Supporters, numbering in the tens of millions worldwide, credit him with freeing them from the “rat race,” providing a clear framework for wealth-building, and demystifying the world of finance. Regardless of one’s stance, his impact is undeniable. He predicted the 2008 housing crash years in advance in his books, consistently warns about the dangers of fiat currency and massive debt, and advocates for financial education as a form of self-defense in an economically volatile world.

The corpus of Financial Books by Robert T. Kiyosaki is the tangible output of this life’s work—a blend of personal anecdote, economic theory, practical advice, and provocative prophecy. They are not technical manuals but philosophical guidebooks designed to shift your mindset first, because, as Kiyosaki relentlessly argues, your thoughts determine your financial reality.

The Definitive List: 10 Best Must-Read Financial Books by Robert T. Kiyosaki

A Curated Journey from Mindset to Mastery

The following list is curated not just by publication order, but by the logical progression of a student of wealth. We start with the foundational mindset, move into practical application, explore predictive economic insights, and finally, address legacy and advanced strategies. Each entry includes a summary, the core “why read,” and a direct call to action to begin your transformation with BookScribes.com.

1. Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Rich Dad Poor Dad — 25th Anniversary Edition

The Book That Started a Revolution

- Short Description: This is the seminal work, the cornerstone of all Financial Books by Robert T. Kiyosaki. Through the powerful parable of his two dads, Kiyosaki dismantles the myth that a high income leads to wealth. He introduces the revolutionary definitions that form the bedrock of his philosophy: an asset puts money in your pocket, a liability takes money out. The book explains why the rich acquire income-generating assets (real estate, businesses, intellectual property) while the poor and middle class accumulate liabilities they mistake for assets (mortgages, car loans, consumer debt). It champions financial literacy over traditional job specialization and introduces the iconic “Rat Race” diagram—a cycle of earning and spending that traps most people.

- Why Read This Book: You must read Rich Dad Poor Dad because it is the essential primer for financial awakening. It is less about specific tactics and more about a fundamental cognitive shift. If you have ever wondered why you work harder but don’t seem to get ahead, if you feel trapped in a job you don’t love, or if the standard advice of “get a good job and save money” feels incomplete, this book provides the missing framework. It’s the “why” before the “how.”

- Call to Action: Ready to challenge everything you thought you knew about money?

- Click the link below to purchase Rich Dad Poor Dad from amazon.com and begin your journey out of the Rat Race.

[BUY NOW: Rich Dad Poor Dad on amazon.com]

2. Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom

Rich Dad’s CASHFLOW Quadrant (2nd Edition)

Publisher: Plata Publishing

Publication date: August 16, 2011

Edition: 2nd Edition

Language: English

ISBN-10: 1612680054

ISBN-13: 978-1612680057

Weight: 12 ounces

Dimensions: 6.25 × 0.75 × 9.25 inches

Series: Rich Dad Poor Dad

Discover Your Path to Financial Freedom

- Short Description: If Rich Dad Poor Dad explains why to get out of the Rat Race, the Cashflow Quadrant shows you how by mapping the four ways people earn money: Employee, Self-Employed/Small Business Owner, Big Business Owner, and Investor. Kiyosaki argues that true financial freedom and wealth are found primarily on the right side of the quadrant (B and I), while the left side (E and S) trades time for money and offers little leverage or true security. The book delves into the core values, fears, and technical skills required to move from the left side to the right side. It introduces the powerful B-I Triangle, a framework for the essential components of a successful business or investment.

- Why Read This Book: Read this to diagnose your current financial location and chart your escape route. It provides the mental and strategic blueprint for transitioning from active income (working for money) to passive income (having your money and systems work for you). It’s crucial for anyone feeling stuck in their career or side-hustle, wanting to understand the architecture of a scalable business, or aiming to become a sophisticated investor.

- Call to Action: Identify your quadrant and plan your move to financial freedom. Get your copy of Cashflow Quadrant from amazon.com today.

[BUY NOW: Cashflow Quadrant on amazon.com]

3. Guide to Investing: What the Rich Invest In, That the Poor and Middle Class Do Not!

Rich Dad’s Guide to Investing (Reprint Edition)

Print length: 471 pages

Publisher: Plata Publishing

Publication date: April 3, 2012

Edition: Reprint

Language: English

ISBN-10: 9781612680200

ISBN-13: 978-1612680200

Weight: 1.12 pounds

Dimensions: 6 × 1.25 × 9 inches

Series: Rich Dad Poor Dad

Becoming a Sophisticated Investor

- Short Description: This entry in the Financial Books by Robert T. Kiyosaki canon demystifies the world of investing for the aspiring right-side-of-the-quadrant individual. Kiyosaki distinguishes between the “average investor” (who often loses money) and the “sophisticated investor.” He outlines the 10 Investor Controls one must master, including control over self, income/expenses, and management. The book covers various investment vehicles, with a strong emphasis on real estate and private business ownership, explaining concepts like leverage, tax advantages, and due diligence. It reinforces that investing is not about “hot tips” but about financial education, mindset, and a strategic plan.

- Why Read This Book: Read this when you are ready to move from theory to action in the “I” quadrant. It provides a comprehensive overview of the investor’s mindset and the landscape they operate in. It’s perfect for the saver who is tired of low-yield mutual funds and wants to understand how the wealthy truly build asset columns through strategic, educated investments.

- Call to Action: Stop being an average investor. Start your education toward sophistication. Purchase Rich Dad’s Guide to Investing from our curated collection.

[BUY NOW: Guide to Investing on amazon.com]

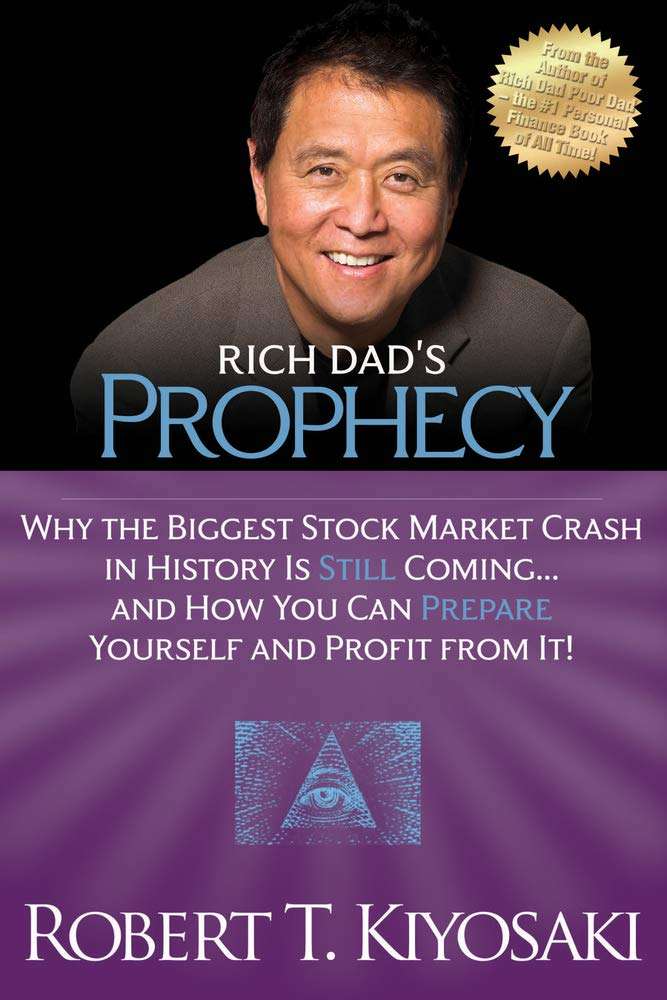

4. Rich Dad’s Prophecy: Why the Biggest Stock Market Crash in History Is Still Coming… and How You Can Prepare Yourself and Profit from It!

A Book of Warning and Opportunity

- Short Description: Published in 2002, years before the 2008 crisis, this book showcases Kiyosaki’s focus on economic cycles and the perils of blind faith in traditional retirement plans. The “prophecy” centers on the inevitable collapse he foresaw due to the massive unfunded liabilities of pension plans (like Social Security) and the blind influx of millions of baby boomers’ money into the stock market via 401(k)s. He argues this creates a “perfect storm” for a devastating crash. The book is not about doom, but about preparation—urging readers to build assets that provide cash flow outside of paper assets (stocks, bonds, mutual funds) and to gain control over their financial future.

- Why Read This Book: Read this for a sobering, macro-economic perspective that is critical in today’s volatile climate. It teaches the importance of financial preparedness, the limitations of conventional retirement advice, and how to structure your wealth to not just survive but thrive during economic downturns. Its prescient warnings make it a timeless lesson in economic self-reliance.

- Call to Action: Don’t be caught unprepared by the next economic cycle. Learn how to protect and profit. Secure Rich Dad’s Prophecy from amazon.com.

[BUY NOW: Rich Dad’s Prophecy on amazon.com]

Publication date: October 1, 2013

Edition: Reprint

Language: English

Pages: 303

ISBN-10: 1612680259

ISBN-13: 978-1612680255

Item Weight: 10.6 oz

Dimensions: 6 x 0.9 x 9 in

Series: Rich Dad Poor Dad

Customer Reviews: ⭐ 4.5/5 (523+)

H4: 5. Why “A” Students Work for “C” Students and “B” Students Work for the Government

H5: Challenging the Education System

- Short Description: In one of the most provocative titles among Financial Books by Robert T. Kiyosaki, he turns his critique toward the traditional education system. He argues that schools are designed to produce employees (E quadrant) and specialists (S quadrant), not financially literate entrepreneurs or investors (B and I quadrants). The “A students” master the system of memorization and test-taking but often lack the financial intelligence, creativity, and risk-taking mentality needed to build wealth. The book is a call to action for parents to provide the financial education schools omit and encourages a shift in what we value in our children’s development.

- Why Read This Book: Read this if you are a parent, a student, or anyone questioning the conveyor belt of formal education. It provides a powerful rationale for supplementing academic learning with real-world financial skills. It helps explain why many highly educated professionals struggle financially while some less traditionally “academic” individuals excel at wealth creation.

- Call to Action: Rethink education for the 21st century. Get this crucial book for parents and future-builders at BookScribes.com.

[BUY NOW: Why A Students Work for C Students on BookScribes.com]

H4: 6. The Business of the 21st Century

H5: The Power of Network Marketing

- Short Description: In this book, Kiyosaki specifically endorses network marketing (also known as direct sales or multi-level marketing) as a legitimate and powerful vehicle for entering the “B” quadrant with low start-up costs and a built-in support system for personal development. He separates the concept from pyramid schemes, framing it as a business that teaches essential entrepreneurial skills like sales, leadership, communication, and overcoming rejection. He argues it’s a modern business school for the masses, providing a proven system and a path to passive income through team building.

- Why Read This Book: Read this with an open mind if you are skeptical of network marketing or are looking for a low-barrier entry into business ownership. Kiyosaki provides a clear, principles-based argument for why this model aligns with Rich Dad principles of leverage, residual income, and personal growth. It’s a specific “how-to” for one path on the B quadrant.

- Call to Action: Explore a 21st-century business model aligned with Rich Dad principles. Discover The Business of the 21st Century now.

[BUY NOW: The Business of the 21st Century on BookScribes.com]

H4: 7. Unfair Advantage: The Power of Financial Education

H5: Why Financial Literacy is Your Greatest Asset

- Short Description: This book consolidates the core idea that runs through all Financial Books by Robert T. Kiyosaki: your greatest wealth-building tool is your financial education, which gives you an “unfair advantage” in a rigged game. Kiyosaki outlines five key “unfair advantages” that the financially literate possess: 1) Knowledge, 2) Taxes, 3) Debt, 4) Risk, and 5) Compensation. He explains how the rich use debt and taxes to make money, while the poor and middle class are crushed by them. It’s a direct attack on the notion of a “level playing field” and a manifesto for arming oneself with specific knowledge.

- Why Read This Book: Read this for a powerful, condensed argument on the non-negotiable importance of financial intelligence. It’s a great book for those who understand the basics of assets/liabilities and the quadrants and are now ready to deep-dive into the tactical advantages that education provides in the areas of tax strategy, using OPM (Other People’s Money), and risk management.

- Call to Action: Claim your unfair advantage. Start with the knowledge in this book. Purchase your copy here.

[BUY NOW: Unfair Advantage on BookScribes.com]

H4: 8. Second Chance: for Your Money, Your Life and Our World

H5: Your Roadmap for the New Economy

- Short Description: Second Chance is Kiyosaki’s post-2008 crash analysis and forward-looking guide. He reviews the lessons from the crisis, reinforces why his warnings in earlier books like Prophecy were valid, and argues that we are now in a period of “financial turbulence” that will continue. The book is structured as a “second chance” for readers to learn from past mistakes (both personal and societal) and to correct course. It covers history, economics, and personal finance, urging readers to move from an industrial-age mindset to an information-age mindset, focusing on adaptability, continuous learning, and entrepreneurial spirit.

- Why Read This Book: Read this for a contemporary context to the Rich Dad principles. It’s ideal for anyone who lived through the 2008 crisis or is navigating the economic uncertainties of the 2020s and beyond. It provides both a historical framework and a urgent call to action to use this “second chance” to build genuine, cash-flowing wealth.

- Call to Action: Don’t waste the lessons of the past. Seize your second chance. Get the book from BookScribes.com.

[BUY NOW: Second Chance on BookScribes.com]

H4: 9. Why the Rich Are Getting Richer

H5: What Is Financial Education… Really?

- Short Description: Positioned as the “summary book” and a “graduate course” all in one, this book asks the central question of our time. Kiyosaki argues that the widening wealth gap is fundamentally an education gap. He goes back to the basics but at a deeper level, explaining what true financial education is (and isn’t). He delves into the history of money, banking, and taxation, explaining how the system is designed and how the financially educated can operate within it. The book emphasizes that in a world of quantitative easing and massive debt, traditional savers are the biggest losers, and asset owners are the winners.

- Why Read This Book: Read this for a profound, almost philosophical, culmination of Kiyosaki’s life’s work. It’s for the reader who has consumed his earlier works and wants a more advanced synthesis, connecting monetary policy to personal strategy. It’s arguably the most important of his later Financial Books by Robert T. Kiyosaki.

- Call to Action: Understand the root causes of wealth inequality and your place in the new economy. Dive into Why the Rich Are Getting Richer.

[BUY NOW: Why the Rich Are Getting Richer on BookScribes.com]

H4: 10. Fake: Fake Money, Fake Teachers, Fake Assets

H5: How Lies Are Making the Poor and Middle Class Poorer

- Short Description: In his most confrontational title, Kiyosaki identifies three “fakes” he believes are crippling people financially: 1) Fake Money: Fiat currency not backed by gold, printed endlessly by central banks. 2) Fake Teachers: Financial “experts” (often from the E and S quadrants) giving advice that keeps people poor. 3) Fake Assets: Things like savings accounts, 401(k)s, and even some real estate that are marketed as safe but are actually losing purchasing power due to inflation and systemic risk. The book is a call to seek real education, real assets (like gold, silver, productive real estate), and real mentors.

- Why Read This Book: Read this as a final wake-up call to develop critical thinking about the financial world. It’s a bold, no-holds-barred critique of the modern financial system and a guide for seeking truth and substance in an era of deception and illusion. It pushes the reader to ultimate self-reliance.

- Call to Action: Learn to distinguish the real from the fake. Build wealth that lasts. Order Fake from our secure site now.

[BUY NOW: Fake on BookScribes.com]

Conclusion: Your Financial Education Starts Here

The journey through these 10 Best Must-Read Financial Books by Robert T. Kiyosaki is more than a reading list; it is a progressive curriculum for financial emancipation. From the initial mindset shift in Rich Dad Poor Dad to the advanced systemic warnings in Fake, Kiyosaki constructs a coherent worldview that prioritizes financial intelligence as the most crucial form of self-defense and empowerment in the modern world.

These Financial Books by Robert T. Kiyosaki are not without their detractors, and they should not be swallowed uncritically. They are, however, undeniably effective at achieving their primary goal: to shock the reader out of financial complacency, to question inherited dogma, and to provide a structured language and framework for building wealth on one’s own terms. They emphasize action, courage, and continuous learning over security, fear, and blind obedience.

Your next step is clear. Begin with the cornerstone, Rich Dad Poor Dad. Let it challenge your assumptions. Then, use the Cashflow Quadrant to map your escape from the left side to the right. Fill in your knowledge with the guides to investing, the warnings of prophecy, and the specific strategies for business. Ultimately, internalize the core message that echoes through every page of every one of these Financial Books by Robert T. Kiyosaki: Your greatest asset is your mind. Once trained in financial literacy, it can create wealth beyond imagination and freedom beyond measure.

Visit BookScribes.com to build your collection, chapter by chapter, lesson by lesson. Your rich dad education awaits.